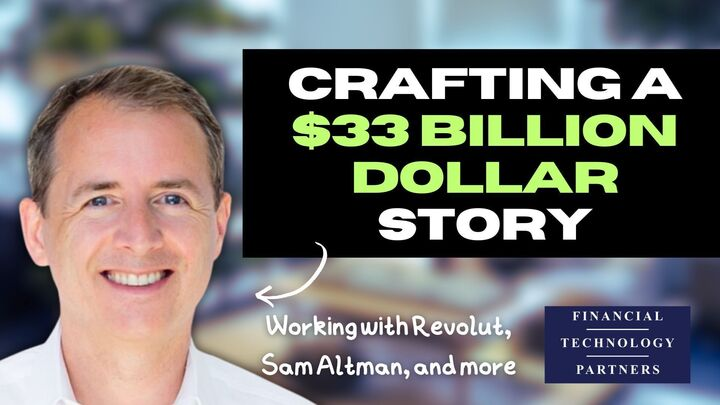

FT Partners’ Steve McLaughlin Featured on Turpentine Finance Podcast with Sasha Orloff: “The Dealmaker’s Secrets: Steve McLaughlin on Crafting A Fundraise Story Worth $33B, FT Partners' CEO”

In this conversation, Sasha Orloff sits down with Steve McLaughlin, CEO and Managing Partner of FT Partners. Steve provides an insider’s look into the high-stakes world of capital raising and dealmaking for high-growth private companies. From being Goldman Sachs’ Former Head of FinTech to founding FT Partners, a global FinTech investment bank, McLaughlin shares his strategies for crafting compelling narratives that unlock massive fundraising rounds - like the $33 billion valuation for Revolut and a $100 million plus raise for Sam Altman’s Worldcoin. They dive deep into storytelling, the importance of product over marketing spend, founder red flags, and much more.

FT Partners’ Founder & CEO Steve McLaughlin featured on How I Invest Podcast “What FinTech Will Look Like in 5 Years”

In this episode, David Weisburd speaks with Steve McLaughlin, Founder, CEO, and Managing Partner of FT Partners, widely regarded as the leading investment bank in FinTech. The podcast covers everything from the humble beginnings of FT Partners, to Steve’s philosophy of “never die,” to his groundbreaking thesis on AI, tokenization, defensibility in FinTech, and why he believes we’re entering a new era of trillion-dollar global financial technology companies. The podcast also dives into the incentives model Steve built that has generated some of the largest fees in the history of investment banking—and why clients keep coming back. This conversation is packed with insights on strategy, resilience, AI’s impact on banking, and the future of FinTech.

FT Partners’ Founder & CEO Steve McLaughlin featured on FinTech Leaders Podcast “FinTech’s Multi-Billion Comeback: From Darkest Days to Record Deals”

Host Miguel Armaza sat down with Steve McLaughlin at the FinTech NedCon conference in Miami. Since 2001, Steve has built a 250-person firm that’s advised on landmark deals including Coinbase’s $4.3 billion Deribit acquisition and Revolut’s multi-billion dollar raises. FT Partners works with everyone from early-stage startups to industry giants. What makes Steve’s perspective invaluable is his position at the absolute center of fintech dealmaking. According to Steve, FT Partners is signing more engagement letters than ever, closing more deals than ever, and expects 2026 to be a blowout year. In this conversation, Steve shares his unfiltered views on Fintech’s dramatic recovery, the tokenization revolution, and why AI will completely reshape financial services.

FT Partners Served as Financial Advisor & Leads Investment in Model ML; Enters Strategic AI Design Partnership

On November 24, 2025, Model ML, a leading global AI workflow automation platform for financial services, announced that it has raised $75 million in Series A financing led by FT Partners including significant participation from Y Combinator, QED, and LocalGlobe. Model ML tackles one of financial services’ most persistent challenges: the manual, time-intensive creation of Word, PowerPoint, and Excel deliverables; its AI agents interpret schemas, reason across data sources, write transformation code, and generate fully verified, branded outputs – allowing teams to focus on analysis and decision-making rather than formatting and cross-checking. As part of the financing, FT Partners and Model ML have entered a multi-year strategic design partnership to jointly develop AI-driven workflow systems that transform how financial analysis and client deliverables are produced. FT Partners served as financial advisor to Model ML and an affiliate of FT Partners also led the round.

FT Partners Served as Financial Advisor to Deribit on its $4,300,000,000 Sale to Coinbase

On May 8, 2025, Coinbase announced that it has entered into a definitive agreement to acquire Deribit for a total consideration consisting of $700 million in cash and 11 million shares of Coinbase Class A common stock. The transaction closed on August 14, 2025; based on Coinbase’s share price at closing, the total consideration amounted to approximately $4.3 billion. Founded in 2016, Deribit is the world’s leading crypto options and futures exchange, providing institutional-grade infrastructure for derivatives trading across Bitcoin, Ethereum, and other major tokens. This strategic acquisition makes Coinbase the global leader in crypto derivatives by open interest and options volume, with Deribit’s robust options platform complementing Coinbase’s rapidly growing US futures and international perpetual futures businesses. This transaction is the largest strategic M&A deal ever in the Digital Assets space.

FT Partners Served as Financial Advisor to Intermex on its $500 million Sale to Western Union

On August 10, 2025, Western Union (NYSE: WU) announced that it has entered into a definitive agreement to acquire International Money Express, Inc. (“Intermex”) (NASDAQ: IMXI) for $16.00 per share in cash. The transaction values Intermex at a total equity value of approximately $500 million. The purchase price represents a 72% premium over the company’s unaffected price of $9.28 on August 8, 2025. Founded in 1994, Intermex applies proprietary technology enabling consumers to send money from the United States, Canada, Spain, Italy, the United Kingdom and Germany to more than 60 countries. This acquisition strengthens Western Union’s retail offering in the U.S., increases market coverage in high potential geographies, and is expected to accelerate digital new customer acquisition

FT Partners Served as Financial Advisor to Bilt on its $250,000,000 Financing

On July 10, 2025, Bilt announced it has raised $250 million in new primary funding at a valuation of $10.75 billion. The round was led by General Catalyst and GID with participation from United Wholesale Mortgage. Bilt is the payments and commerce network that transforms housing and neighborhood spend into rewards and benefits for everyone involved, and the first program to allow members to earn rewards on rent and HOA payments while building a path to homeownership. The new funding and valuation reflect the momentum the Company has built since its launch; Bilt expects to reach $1 billion in revenue by Q1 2026 and expects to process more than $100 billion annually in housing spend by the end of 2025.

FT Partners Served as Financial Advisor to AvidXchange on its $2,200,000,000 Sale to TPG & Corpay

On May 6, 2025, AvidXchange Holdings, Inc. (NASDAQ: AVDX) announced that it has entered into a definitive agreement to be acquired by a consortium led by TPG (NASDAQ: TPG), a leading global alternative asset manager, and Corpay (NYSE: CPAY), a global leader in corporate payments, for $10.00 per share in cash, which represents a 45% premium over the Company’s unaffected price of $6.89. AvidXchange is a leading provider of accounts payable (AP) automation software and payment solutions for middle market businesses and their suppliers. FT Partners has been engaged in a long-term financial advisory role with AvidXchange since 2009 and has since advised the Company on every major capital raise, buyside acquisition, its 2021 IPO, and its announced sale in 2025 to TPG, totaling over 16 transactions. AvidXchange's equity value has increased over 100x over this time period.

FT Partners Served as Financial Advisor to Hidden Road on its $1,250,000,000 Sale to Ripple

On April 8, 2025, Ripple Labs announced that it has entered into a definitive agreement to acquire Hidden Road for a total consideration of $1.25 billion, one of the largest deals ever in the digital assets space. Founded in 2018, Hidden Road is one of the fastest-growing prime brokers globally, offering institutions a one-stop-shop of advanced services including clearing, prime brokerage, and financing across foreign exchange (FX), digital assets, derivatives, swaps, and fixed income. With the acquisition, Ripple becomes the first crypto company to own and operate a global, multi-asset prime broker.

FT Partners’ Founder & CEO Steve McLaughlin featured on Slice of Finance Podcast

In the episode, Steve and host Jared Taylor discuss Steve’s journey from Goldman Sachs to founding FT Partners, IPOs vs why companies are staying private longer, and current FinTech trends – beyond AI – such as identity and security, and stablecoins and B2B payments.