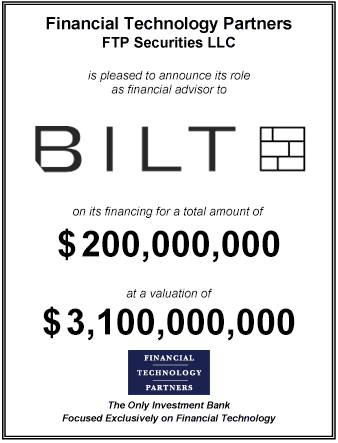

FT Partners Advises Bilt on its $200,000,000 Financing

Overview of Transaction

- On January 24, 2024, Bilt Rewards (“Bilt”) announced that it raised $200 million in financing led by General Catalyst (sourced by Bilt) with a significant contribution by Eldridge (sourced by FT Partners) and participation from existing investors Left Lane Capital, Camber Creek and Prosus Ventures

- The round values Bilt at $3.1 billion, more than double its previous valuation of $1.5 billion from October 2022

- As part of the transaction, Ken Chenault, Chairman and Managing Director of General Catalyst, joins the board as Chairman, while Roger Goodell, the Commissioner of the NFL, joins as Independent Director

- Based in New York, Bilt Rewards is the first program for consumers to earn valuable rewards on rent and daily neighborhood spend while creating a path to home ownership

- Through its Bilt Rewards Alliance, a partnership with America's leading residential real estate companies, the Company enables renters in nearly four million units across the US to earn Bilt Points just by paying rent, while these owners benefit from resident loyalty, cost savings and a share of revenue

- In 2023, Bilt developed its Neighborhood Rewards program that rewards customers for spending on local businesses, such as dining, rideshares, and groceries

Significance of Transaction

- Bilt will use the new capital for strategic initiatives, namely expanding the Bilt Rewards Alliance across multifamily, single-family and student housing sectors nationwide, and growing the Neighborhood Rewards program among local merchants; additionally, Bilt plans to venture into mortgage payment rewards

- Bilt's financial trajectory continues to grow, with the Company achieving EBITDA profitability in 2023 and its annualized member spend nearing $20 billion

FT Partners' Role

- FT Partners advised Bilt on this transaction, bringing in Eldridge as a key investor into the round

- This transaction highlights FT Partners’ domain expertise in the payments and rewards space, along with its successful track record generating highly favorable outcomes for high-growth, unicorn FinTech companies